Written by Yanis Kharchafi

Written by Yanis KharchafiUpdated on December, 10th 2025.

Understanding everything about what we call taxable income in Switzerland

Introduction: Is this article for you?

The goal of this introduction is, for once, to save you time: if you are taxed at source or if you are a cross-border worker, this article is not for you, quite simply because you cannot deduct anything!

This article applies to taxpayers who must file a full Swiss tax return, meaning you fall into one of the following categories:

- You are of Swiss nationality

- You hold a C permit (permanent residence)

- You are married to a Swiss citizen or to someone holding a C permit

- Or you are taxed at source but have had to (or chosen to) file an ordinary subsequent assessment

If you fall into one of these categories, then this article is for you!

The line-up:

Why is it essential to understand how your taxable income is calculated?

Everywhere in the world, paying taxes on one’s professional activity is a given. Yet at FBK Conseils, we are consistently surprised to see that most taxpayers still do not clearly understand the basis on which their taxes are calculated.

The same questions come up again and again:

Are taxes calculated on your gross salary negotiated with your employer? On your net salary after social security contributions? Or on your taxable income after all allowable deductions?

This article aims to clarify exactly that.

In this first section, we will focus exclusively on the situation of employees. Once these elements are clearly understood, we will add a dedicated section for self-employed individuals, who are subject to different rules.

Step 1: Determine the net income or net profit from your gainful activity

Case 1 – Net income for an employee in Switzerland

For those who have chosen to work as employees, your first mission—after convincing the company that you were the right person for the job—will be to negotiate your salary, which generally includes:

- Annual fixed gross salary

- Variable salary based on working hours and/or performance

- Bonuses and incentives

- 13th-month salary

- Employee shares

- Various financial benefits (supplementary health insurance, etc.)

It is only once this negotiation is complete that you will have a clear vision of your annual gross income. All good? Then let’s move on to the next step: net income.

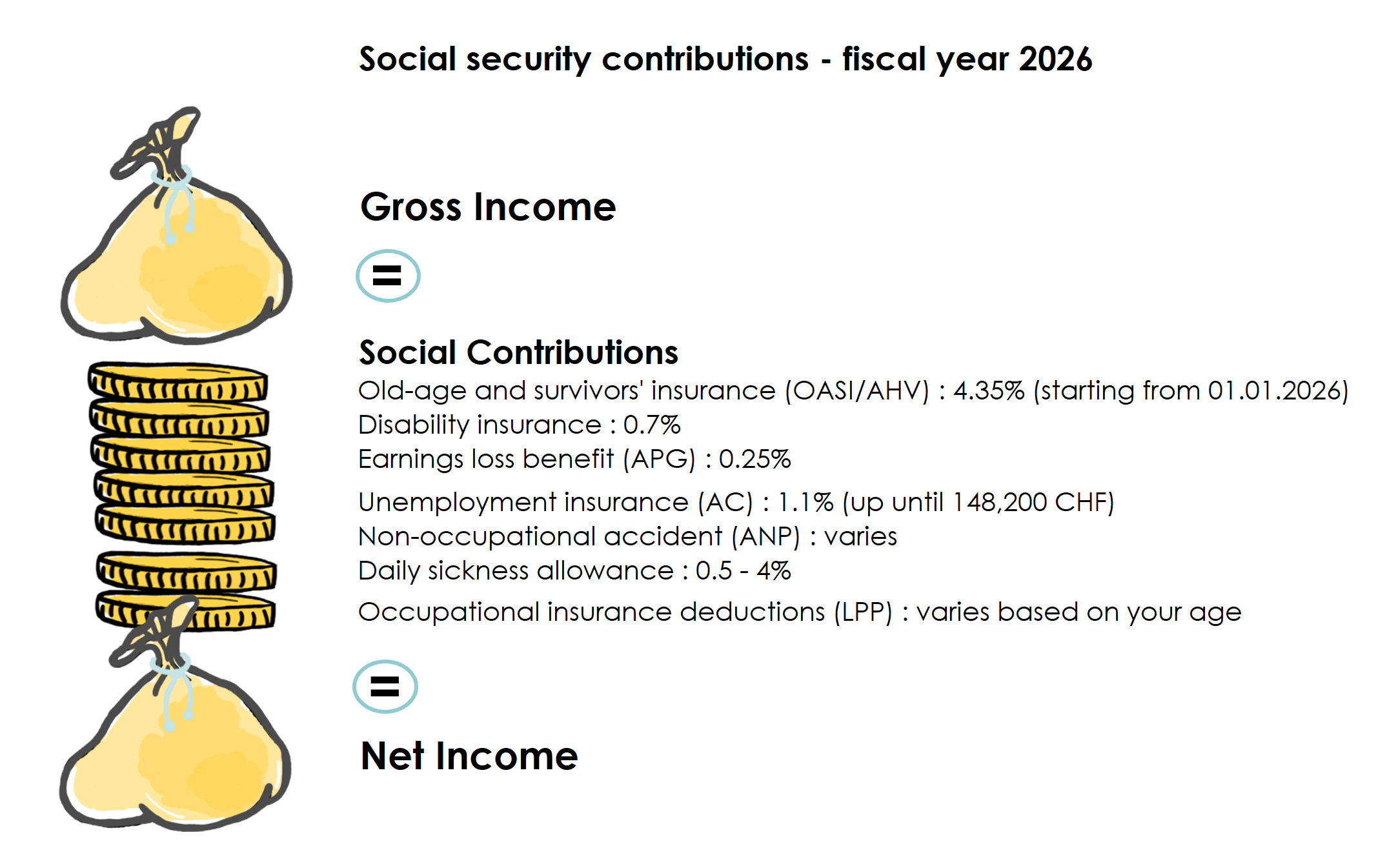

Your net income consists of that gross income minus all the deductions withheld from your salary month after month—without needing your explicit approval. If you have already started your job, you’ve probably noticed these deductions on your monthly payslip. You will see that a number of items—some small, some significant—accumulate and ultimately weigh heavily.

Among these deductions, you’ll find those related to your retirement (AVS, LPP) and those linked to life’s risks (LAA, AC, AF, IJM, APG, etc.).

Some of these deductions will be identical whether you work for the CHUV or for FBKConseils, while others depend largely on the generosity of your employer and their social benefits policy.

Visually, here’s what this should look like for the year 2026.

This chart is reproduced each year by your employer in a document called the salary certificate. This document serves as the foundation for preparing your tax return and, more broadly, for estimating your overall tax burden.

Case 2 – Net profit for a self-employed person in Switzerland

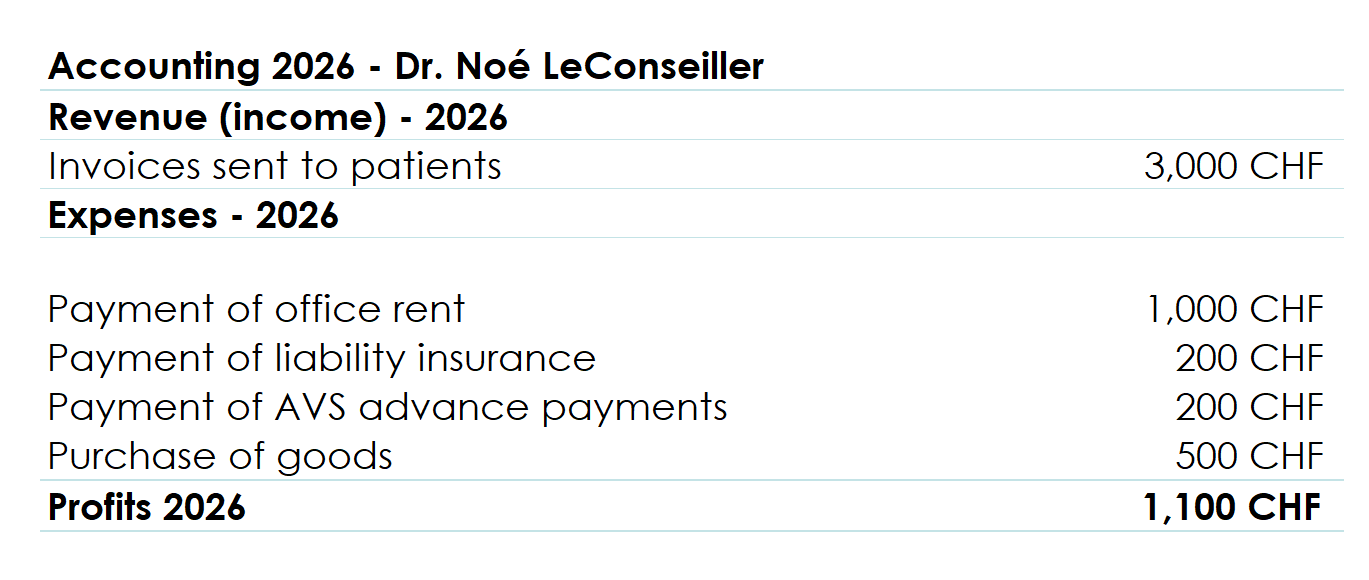

In this second scenario, we are looking at the situation where you decided to take the leap, go all-in, and set up a sole proprietorship. It is now up to you to find clients, negotiate in your own name, and bill for your time and work.

For you, things are slightly more complex on paper but more “flexible” in practice: you must maintain proper bookkeeping. It is based on your annual accounts that your net operating profit will be determined—this is effectively the self-employed equivalent of an employee’s salary certificate.

In short, and without repeating everything explained in our detailed article on accounting for self-employed individuals in Switzerland, the operating profit of a self-employed person simply results from adding up your earnings:

Revenue side:

- Goods and services sold (excluding VAT)

- Exceptional income (returns on business assets)

- Income from the sale of business assets

Minus all expenses and costs paid during the same period:

- Salaries for your employees

- Subcontracting

- Raw materials

- Business travel and meals

- Administrative expenses

- Insurance

- Retirement contributions (self-employed AVS)

- Etc.

In principle, all these calculations appear automatically in your income statement, giving you the annual taxable profit.

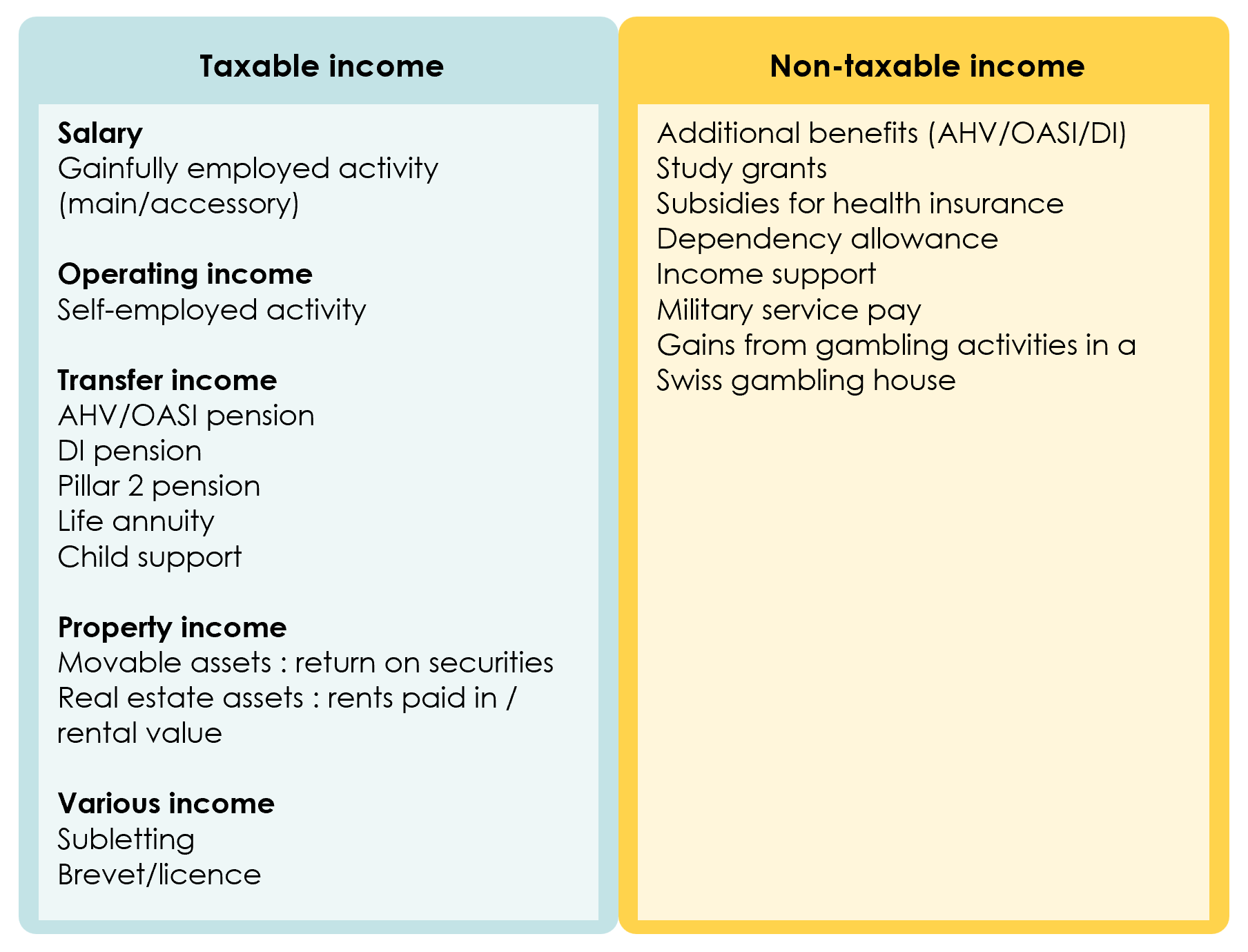

Step 2: Add the pensions and annuities received

In this second step, whether you are self-employed or an employee no longer matters—the process will be almost exactly the same from here on. This stage begins by adding all pensions and annuities received between 01.01.2026 and 31.12.2026:

- AHV / IV pensions

- Occupational pension (LPP/BVG) or accident insurance (LAA) pensions

- Daily sickness benefits (if not paid directly by an employer)

- Family allowances

- Maintenance payments received for yourself or a minor child

- Life annuities from life-insurance contracts

- Etc.

Step 3: Add income from movable and immovable assets

Yes, that’s right! Investing your money and protecting it from inflation is great… but it does come with a tax cost. If through experience (or luck) you have found a profitable strategy — and if this strategy produces something that looks like income, then it will be taxed just like any other income.

Among these sources of income, it is important to distinguish income from movable assets from income from real estate.

Income from movable assets

In this section, we consider everything that is not related to real estate, such as:

Bank accounts:

Guaranteed interest (if you still manage to find some!).

Investment accounts (IBKR, Yuh, or any other trading platform):

You must declare the dividends and coupons received.

A quick side note: we are not talking here about withholding tax or foreign tax withheld at source. Feel free to read our article on the taxation of investment funds for more details.

Loans to third parties:

Less common, but good to know. If you lent money to your little cousin and don’t like her that much, you can decide, like in gangster movies, to charge interest. These interest payments will be taxable (with the exception of certain interest on savings capital, which may be deductible depending on your canton).

In short, if you invest in financial assets, most of the income generated will be taxable.

Important! In Switzerland, there is one major exception: capital gains on privately held assets are not taxable.

Income from real estate

As with movable assets, the goal here is not to dive deeply into real estate taxation, but simply to make one thing clear: whether your property is rented out or not, you must declare (and this remains true until 2028):

- The imputed rental value when the property is not rented out. This fictitious income will be abolished in 2028 with the introduction of the new tax reform.

- The gross rent received from your tenants.

And one more detail: Switzerland is one of the last countries in the world to still levy a wealth tax in addition to taxing investment income, but that’s not the focus of today’s topic!

Summary of your taxable income in Switzerland

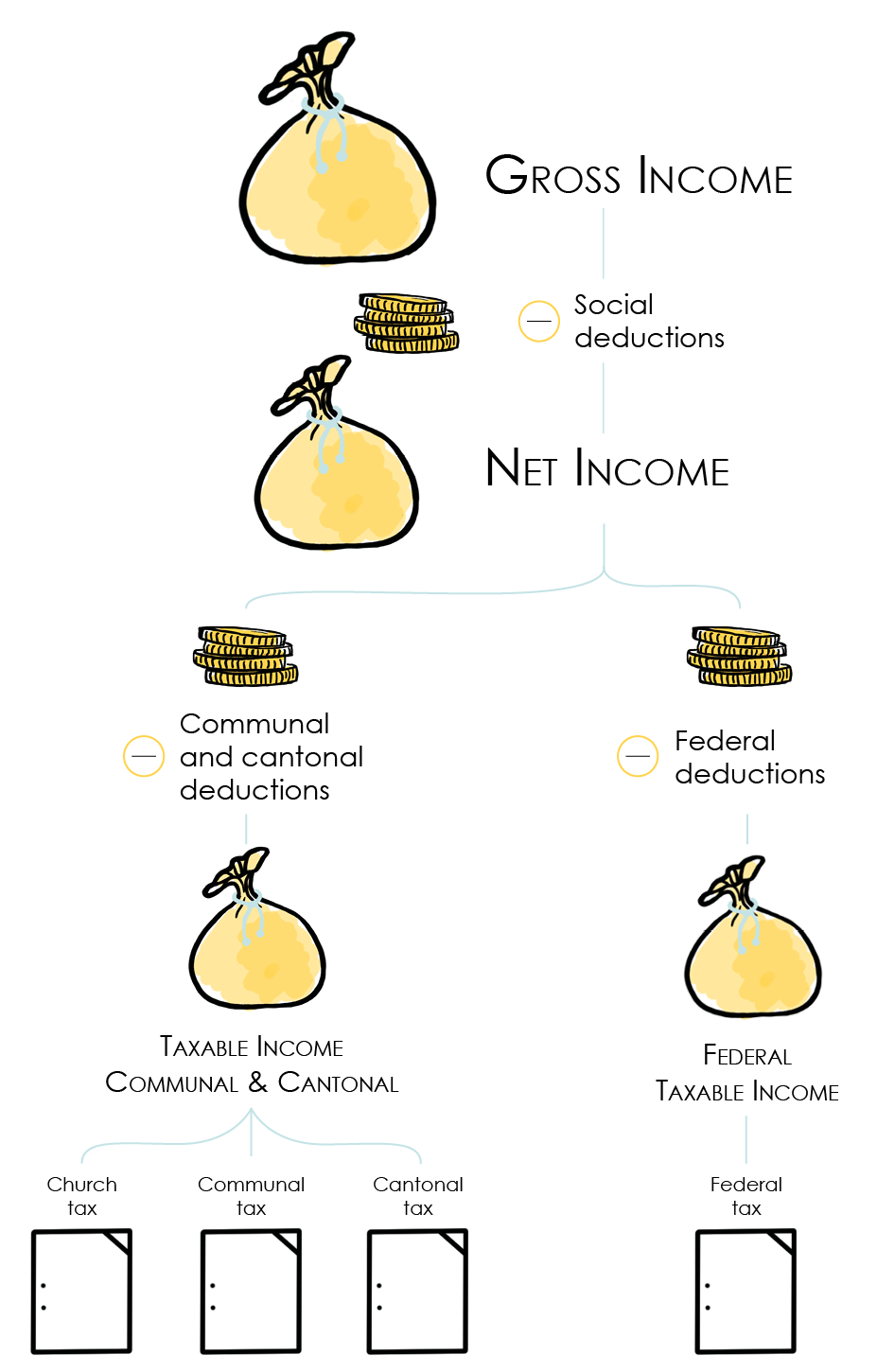

At this stage, we have completed the first part of calculating taxable income in Switzerland. In other words, we have identified all the sources of income that will be added together to obtain what we might call your “global net income.” (Technically, this term doesn’t exist in the law — I just invented it — but it’s helpful to better understand what comes next.)

This is where the second part of the calculation begins. Now that we know everything that will be taxed, we must not forget that everywhere in Switzerland, even though there are significant differences between cantons, you are allowed to make tax deductions.

Some of your expenses, whether actual or based on a fixed allowance, can reduce your global net income and ultimately determine your taxable income!

Step 4: Calculating your taxable income

Hold on tight, because from here on, things may become a bit more confusing! As you probably know, Switzerland is made up of many cantons and, unfortunately for you (and for us), each canton has more or less flexibility to define the tax deductions available to its residents.

And remember: in Switzerland, you pay income tax at three different levels:

- At the level of your municipality of residence — for example Lausanne for Vaud, Lancy for Geneva, or Sion for Valais

- At the level of your canton of residence — Vaud, Geneva, Valais, etc.

- At the level of the Confederation — which is the same across all of Switzerland

The complexity of the two deduction systems

Here’s where things really become complicated: for the canton and the municipalities, it is the canton that decides. It sets the rules regarding tax deductions, which means that your taxable income for the canton and for your municipality will always be identical. Tax professionals refer to this as the ICC taxable income (for Cantonal and Municipal Tax).

Then, the Confederation applies its own set of rules, resulting in what we call the IFD taxable income (Federal Direct Tax).

In conclusion: two parallel calculations (your canton & municipality on one side, and the Confederation on the other)

Once you have determined your global net income, you must divide this income into two distinct calculations:

- The calculation for your canton and municipality of residence, which will apply its own deductions to determine your ICC taxable income

- The calculation for the Swiss Confederation, which will also apply a set of deductions (sometimes different) to determine your IFD taxable income

What deductions are authorized by your canton and municipality of residence?

Broadly speaking, the types of income tax deductions are similar from canton to canton, but the amounts deductible can vary considerably. Here are the main categories of commonly accepted deductions:

- Transport expenses ;

- Meal expenses ;

- Various professional expenses (other professional expenses) ;

- Health insurance (LAMal and LCA premiums) ;

- Medical expenses;

- Interest paid on property and consumer loans;

- Training costs ;

- Bank charges ;

- Childcare costs;

- etc.

Although these deductions are generally recognised, each canton sets its own ceilings, which can have a significant impact on your taxable income.

It is important to note that certain deductions accepted in one canton may be excluded in another. For example:

- The 3rd pillar B is deductible only in three cantons, including Geneva, but is rejected in the canton of Vaud.

- Interest on building loans is accepted in the canton of Valais, but refused in Geneva and Vaud.

- Other business expenses are accepted as a lump sum in the canton of Vaud, but are excluded in the cantons of Geneva and Valais.

To help you better understand these specificities, we have prepared three articles dedicated to each canton of residence:

- The main deductions in the canton of Vaud

- The main deductions in the canton of Geneva

- The main deductions in the canton of Valais

These guides will help you calculate your taxable income at cantonal level. But what about taxable income at federal level?

What income tax deductions are available at federal level?

If you understand how deductions work at cantonal level, you’ll find federal deductions easier to understand. The Swiss Confederation allows virtually the same deductions as the cantons, although the amounts and lump sums may vary. To help you navigate direct federal tax, we recommend that you consult our specific section : How to calculate one’s direct federal taxation (DFI/IFD)?

Step 5: Determine your annual tax burden

Once you have determined your taxable income (CCI and DFI), all you need to do is (in quotes) understand the calculation method specific to your canton of residence to estimate your income tax. Each canton in Switzerland has developed its own method of calculating tax, and the differences between them are sometimes considerable. At FBKConseils, we’re here to help you through this complex process, by helping you to understand the tax specifics of your canton.

- Understanding your income taxes in the canton of Vaud

- Understanding income tax in the canton of Geneva

- Communal income taxes in Valais

Tips and tricks for better managing your taxable income

- Tip no. 1: When you start any professional activity, take the time to find out about social security contributions. Does your employer contribute generously to your pension? Is there sufficient cover for accident, disability and death? What will your net income be after all contributions have been deducted?

- Tip no. 2: Familiarise yourself with your payslip and salary certificate, which are the key documents for understanding your income and the deductions made. If in doubt, don’t hesitate to contact your HR department for clarification.

- Tip no. 3: At FBKConseils, we value self-reliance and financial education. However, we also recommend that you seek professional advice during the first year of filing to ensure that your return is accurate and that all your deductions are included.

How can FBKConseils help you?

As you’ve probably noticed throughout this article—and all the others—at FBK Conseils, we are genuinely passionate about taxation, and more broadly about the financial ecosystem of individuals and businesses living in Switzerland. Our firm can support you in several key areas:

Introductory meeting at no cost

We offer a complimentary 20-minute introductory consultation, which allows you to complete the information found in our articles and, if needed, gives us the opportunity to explain how we work and how we could assist you.

Personalised tax simulations

Life evolves, often in unexpected ways — career changes, family adjustments, new projects… and each of these developments can significantly affect your tax burden.

We assist our clients either directly during advisory meetings or entirely on a delegated basis by performing all the necessary tax and budget simulations to help you anticipate these changes in the best possible way.

More information: Tax and Budget Simulations

Training to complete your tax return

We have created a new service that allows our clients to join us either in our offices or via video call. Together, we go through your tax documents and show you — step by step — how to fill in and optimise your tax return.

Learn more: Tax Return Training

Full delegation of your tax return

If you prefer not to deal with your tax return yourself, our fiduciary firm can take care of everything for you in the traditional way. Simply provide us with your documents, and we handle the entire process from start to finish.